georgia property tax relief for seniors

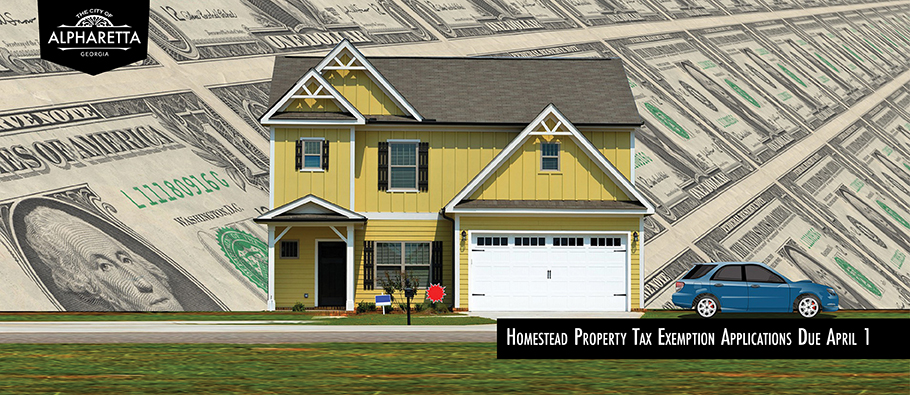

In order to be considered eligible for the program youll have to meet the following criteria. Other forms of property tax relief for retirees in Georgia include an exemption of all property value accumulated after the base year in which a senior age 62 or older applies.

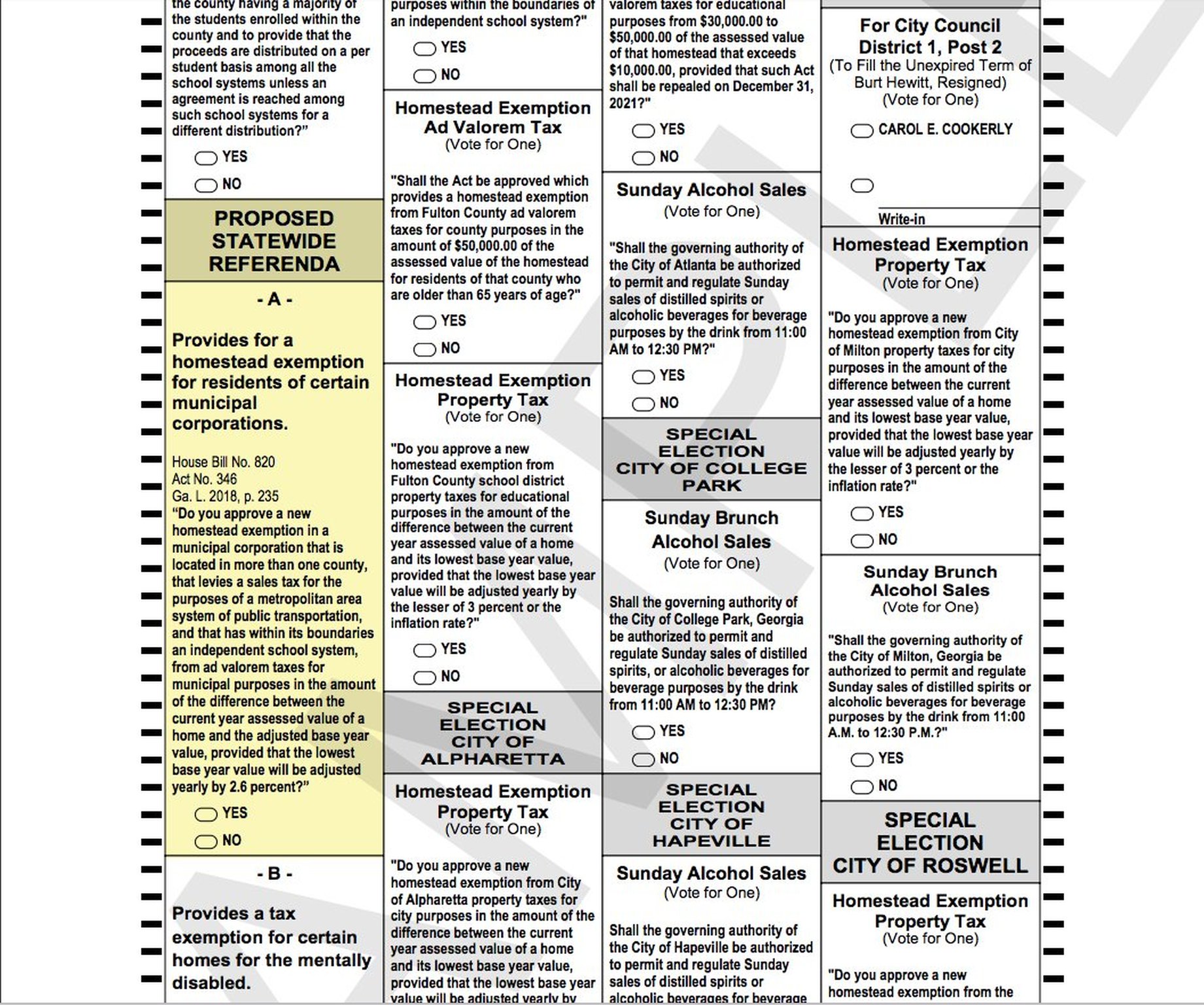

These Are The Ballot Measures You Can Vote On In The Georgia Midterm Election Wabe

Georgia Property Tax Advantages Benefits Deductions and Exemptions for Seniors 65 and Older Homestead Exemption Generally a homeowner is entitled to a homestead exemption on their.

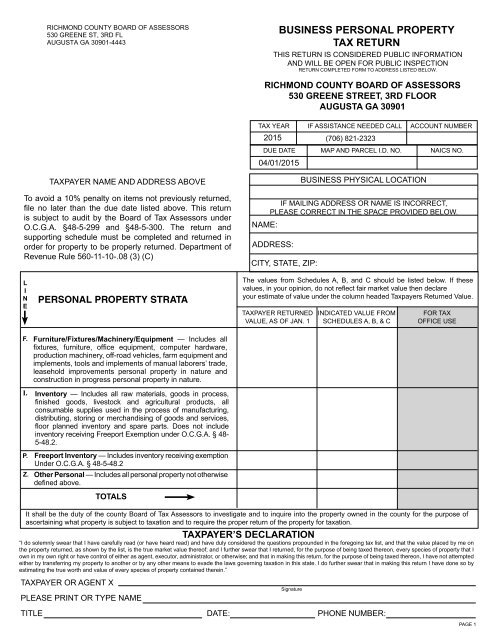

. Alabama exempts senior citizens over the age of 65 from paying a state portion of property taxes. To be granted a property tax exemption in Georgia you have to be the owner of the property from January 1 of that taxable year. Our staff has a proven record.

The exclusion allows a retiree who is 65 year or older to shield from state income. Georgia is ranked with other tax-friendly state such as South Carolina Tennessee Alabama and Colorado due to its low-tax climate tax exemptions tax breaks and affordable. Wednesday May 12 2010 Contact.

Coronavirus Tax Relief FAQs. If youre 62 years old or. A retirement exclusion is allowed provided the taxpayer is 62 years of age or older or the taxpayer is totally and permanently.

The Georgia Department of Revenue has provided relief as specified in the below FAQs and Press Releases. It was founded in 2000 and has been an active. At least 21 years old Verifiable income You must have a minimum balance of 5000 What can.

Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. Further Georgia has an exclusion from state income tax that is directly targeted at seniors. Office of Communications 404-651-7774 ATLANTA Governor Sonny Perdue today announced that he has signed House Bill 1055 a bill.

Its calculated at 50 percent of your homes appraised value meaning youre only paying half the usual taxes for your property. CuraDebt is a company that provides debt relief from Hollywood Florida. Press Releases For more information about the COVID.

Non-military seniors in South Carolina can enjoy a homestead. Residents of Georgia aged 62 years and older are exempt from its 6 tax all social security and 70000 per a couple of income on pensions interest dividends and retirement accounts etc. You must be age 65 or older and have an annual.

Up to 25 cash back If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption. Senior Citizen Exemptions Several options are available for senior citizens in. Heres how it works.

If you are 62 years of age by January 1st of the current tax year you may qualify for a senior exemption that will increase the reduction in the school tax portion of your bill from 200000. There are several property tax exemptions in Georgia and most. About the Company Georgia Property Tax Relief For Seniors.

Any owner-occupied home in Fulton County is eligible for a 2000 reduction in the assessed value of the property. Does Georgia offer any income tax relief for retirees.

Property Tax Deferral For Senior Citizens Minnesota Department Of Revenue

5 Property Tax Deductions In Georgia For You Excalibur

Deadline To File For Homestead Property Tax Exemption Is April 1

City Of Moultrie Moultrie City Council Votes To Offer A Rebate To Elderly Homeowners

Petition Jackson County Georgia Senior Exemption For Eliminating School Taxes Change Org

Fulton County Atlanta Tax Proposals On Nov 6 Ballot

Top Property Tax Protest Companies In Georgia Real Estate Bees Ga Property Tax Reduction Appeal Consultants Services Near Me

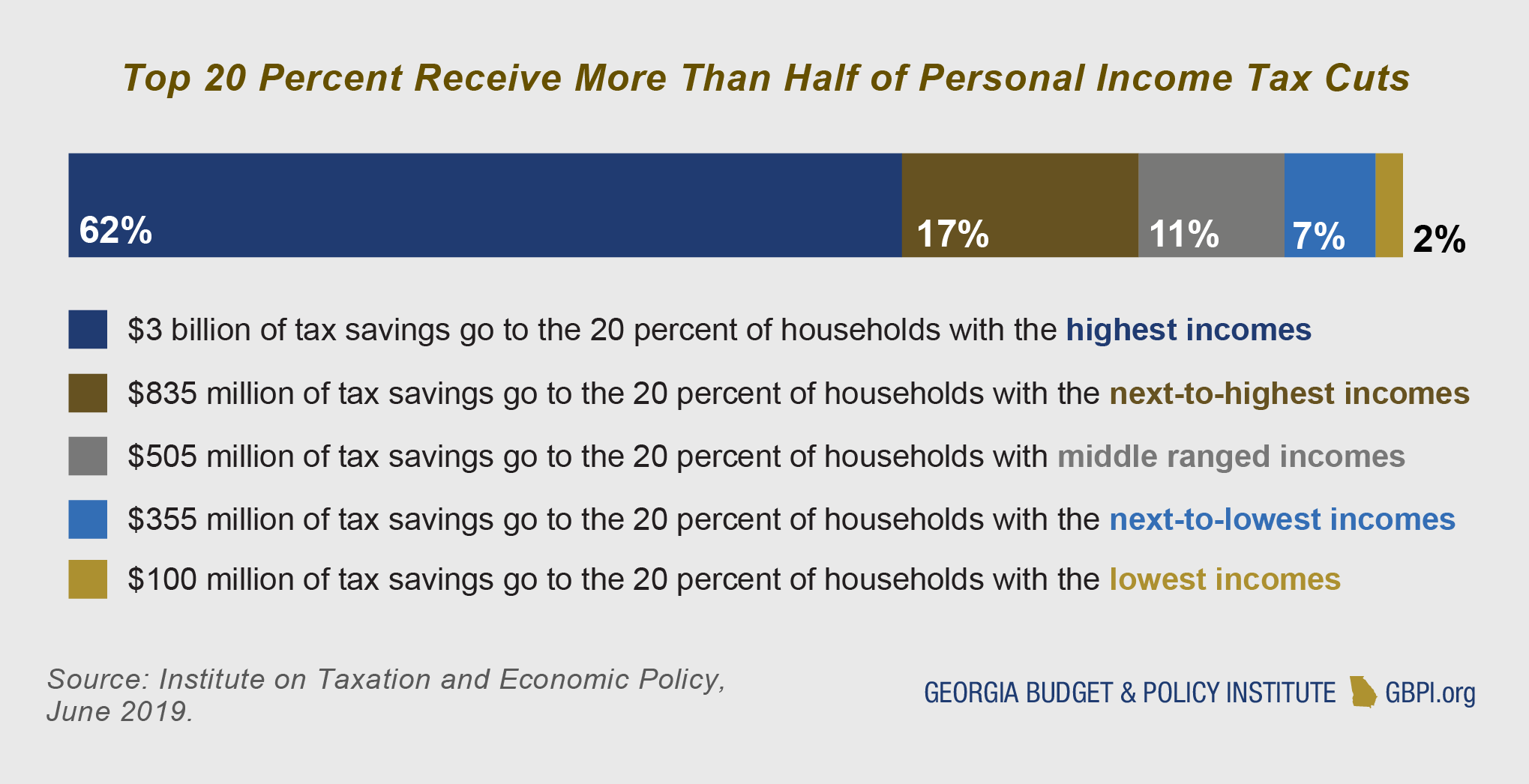

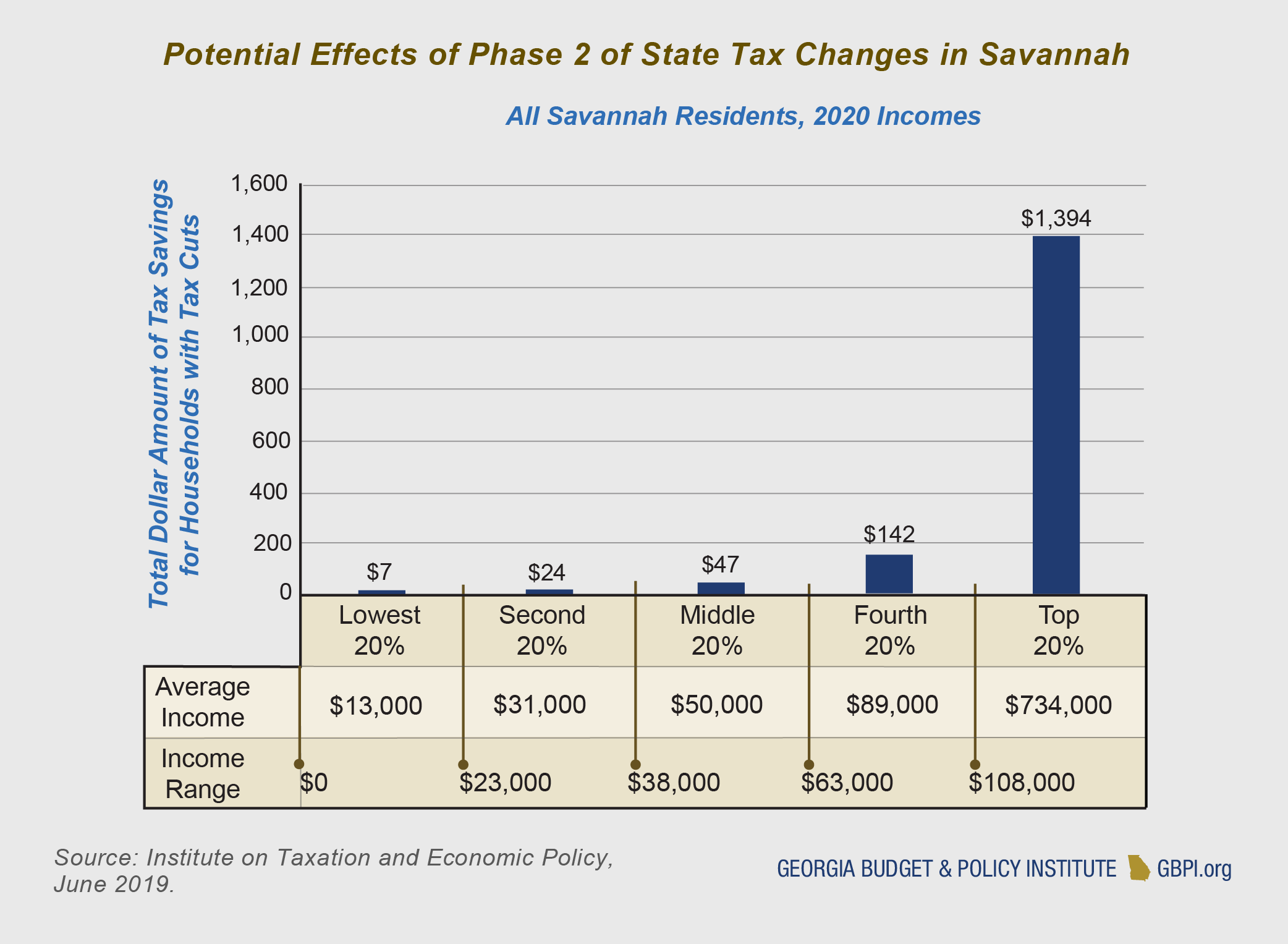

The Tax Cuts And Jobs Act In Georgia High Income Households Receive Greatest Benefits Georgia Budget And Policy Institute

Filing 2020 Taxes Is Complicated By Stimulus Unemployment Macon Telegraph

Georgia Property Tax Exemptions Are You Missing Out

Fulton County Georgia Homestead Exemption For Senior Residents Measure November 2022 Ballotpedia

The Tax Cuts And Jobs Act In Georgia High Income Households Receive Greatest Benefits Georgia Budget And Policy Institute

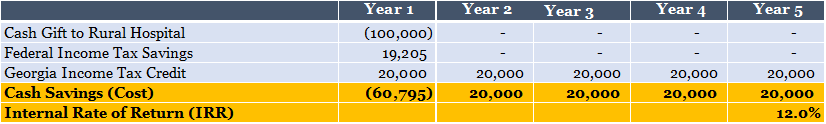

The Newly Expanded Tax Credit That Every Georgia Taxpayer Should Understand Resource Planning Group

The Tax Cuts And Jobs Act In Georgia High Income Households Receive Greatest Benefits Georgia Budget And Policy Institute

Brookhaven Seeks Property Tax Savings For Homeowners Reporter Newspapers Atlanta Intown

Board Of Assessors Homestead Exemption Electronic Filings

/arc-goldfish-cmg-thumbnails.s3.amazonaws.com/07-15-2022/t_c94ac012ea6c415c96ae7e0a566e3695_name_iStock_1139383323.jpg)

Georgia Tax Refund Still Haven T Seen Your Tax Rebate More Are Being Sent Out Soon Wsb Tv Channel 2 Atlanta